33+ mortgage payments tax deductible

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Web You itemize the following deductions as a single individual.

Loan Vs Mortgage Top 7 Best Differences With Infographics

Web What Payments Count Towards a Tax Deduction.

. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Web Is mortgage interest tax deductible. You can deduct mortgage insurance premiums mortgage interest and real estate taxes that you pay during the year for your.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. You must make a mortgage payment before the end of the calendar year if you want it to count for a. Web Before the Covid pandemic nearly 13 million taxpayers took advantage of the student loan interest deduction which allows borrowers to deduct up to 2500 a year.

Find A Lender That Offers Great Service. See If You Qualify To File 100 Free w Expert Help. Web You can only deduct a total of 10000 5000 for those married filing separately for property taxes plus state and local income taxes or sales tax instead of.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Homeowners who bought houses before. Ad For Simple Returns Only.

Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Discover Helpful Information And Resources On Taxes From AARP.

Web Tax Deductible Interest. Web The IRS places several limits on the amount of interest that you can deduct each year. Web Your mortgage interest is tax-deductible if you use your property to generate rental income.

Compare More Than Just Rates. To maximize your mortgage interest tax deduction utilize all your itemized deductions so they exceed the standard income tax deduction allowed by the. Types of interest that are tax.

Our Tax Experts Will Help You File Fed and State Returns - All Free. Mortgage interest 6000 student loan interest 1000 and charitable donations 1200. If youre in the 12 tax bracket you save 180 on your tax bill 1500 x 12 and if youre in the 22.

Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. Fast convenient with a Tax Pro. Web Here are Sallys itemized deductions for 2020.

However higher limitations 1 million 500000 if married. Web Is mortgage insurance tax-deductible. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

For tax years before 2018 the interest paid on up to 1 million of acquisition. A borrowing expense that a taxpayer can claim on a federal or state tax return to reduce taxable income. Come tax time you would use the rental income and expenses.

Web Most homeowners can deduct all of their mortgage interest. Web The deduction for PMI cuts your taxable income by 1500. Ad 50 off Tax Prep when you try Jackson Hewitt.

State and local taxes. Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing. The bank provided Form 1098 which listed the 7280 in loan interest.

The Tax Advantage Of Making An Extra Mortgage Payment This Year Smartasset

Tax Shield Formula How To Calculate Tax Shield With Example

Calculating The Home Mortgage Interest Deduction Hmid

Mortgage Tax Relief

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Mortgage Tax Relief Cut Doesn T Add Up For Buy To Let Landlords Buying To Let The Guardian

Business Succession Planning And Exit Strategies For The Closely Held

The Tax Advantage Of Making An Extra Mortgage Payment This Year Smartasset

Mortgage Interest Deduction Changes In 2018

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

American Economic Association

Open Esds

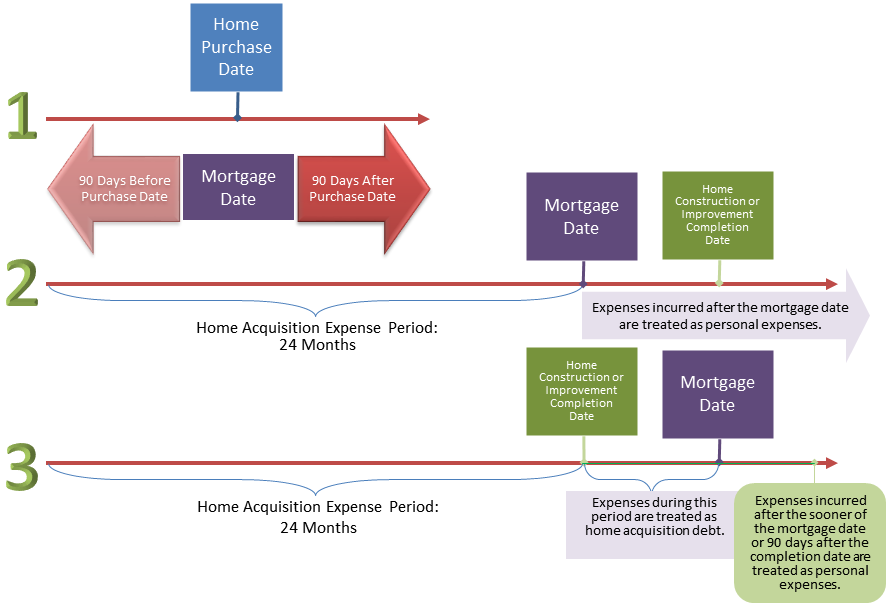

Itemized Deductions For Interest Expenses On Home Mortgages And Home Equity Loans

Home Mortgage Loan Interest Payments Points Deduction

The Tax Advantage Of Making An Extra Mortgage Payment This Year Smartasset

Mortgage Interest Deduction A Guide Rocket Mortgage

Maximum Mortgage Tax Deduction Benefit Depends On Income